Savings Deposits

A flexible account that allows you to easily access your money when you need it.

Shares Savings

Your Shares Account represents part ownership of the Credit Union.

Consumer Loans

Our Consumer Loans are Short Term Regular Loans offered to Credit Union members.

Vehicle Mortgages

Our Vehicle Mortgages are for the financing of Motor Vehicle Purchases only.

About us

At our institution, you can not only save in shares but also earn attractive dividends. Our courteous and experienced staff is dedicated to providing personalized service tailored to your needs. Take advantage of our reduced interest rates on all loans, with the added flexibility of no penalties for lump sum payments.

Enjoy quick and easy approval for ‘within share loans,’ with every loan insured for your safety. Plus, we offer a Family Indemnity Plan to ensure your loved ones are cared for.

Join us today and discover the benefits of saving and borrowing with confidence!

Requirements to Join Us

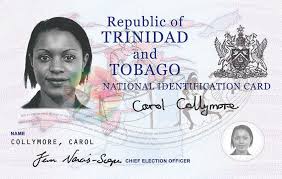

Valid ID

Two Valid forms of Government Issued Identification such as:

National ID and Drivers Permit.

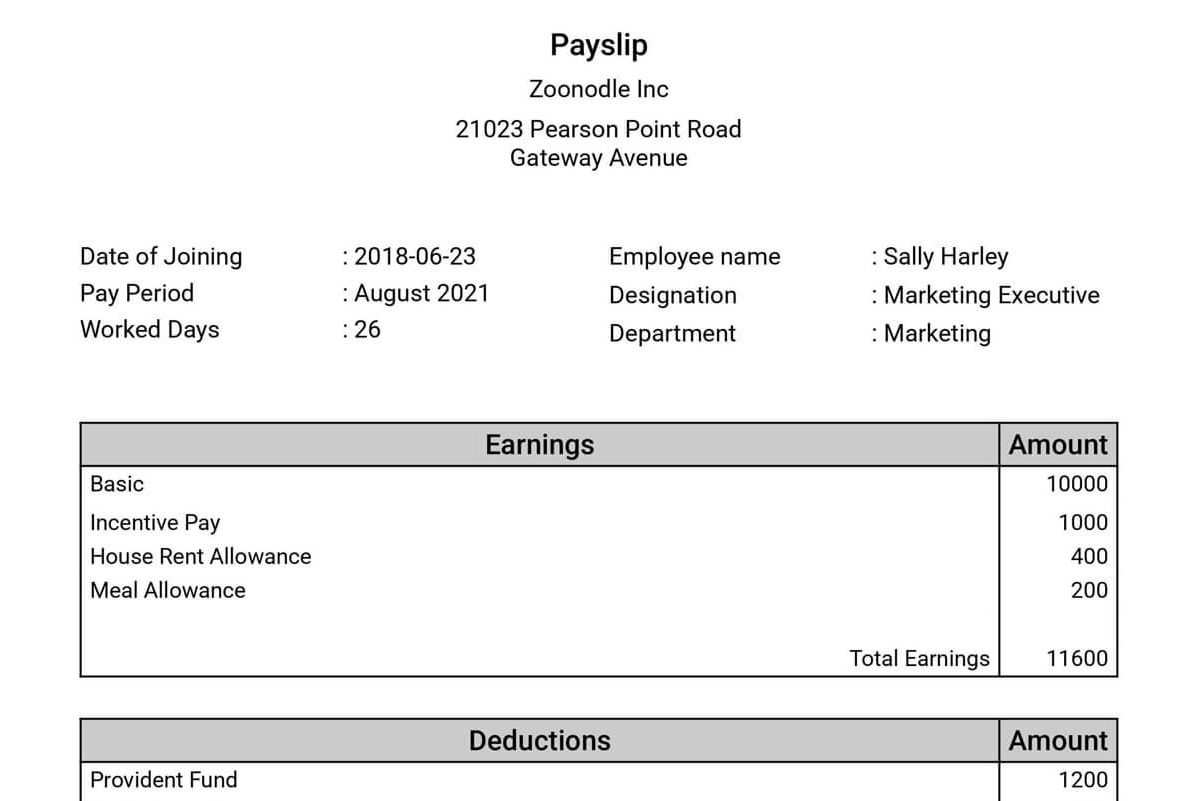

Recent Payslip

A recent payslip within the last month will serve as official proof of employment and income.

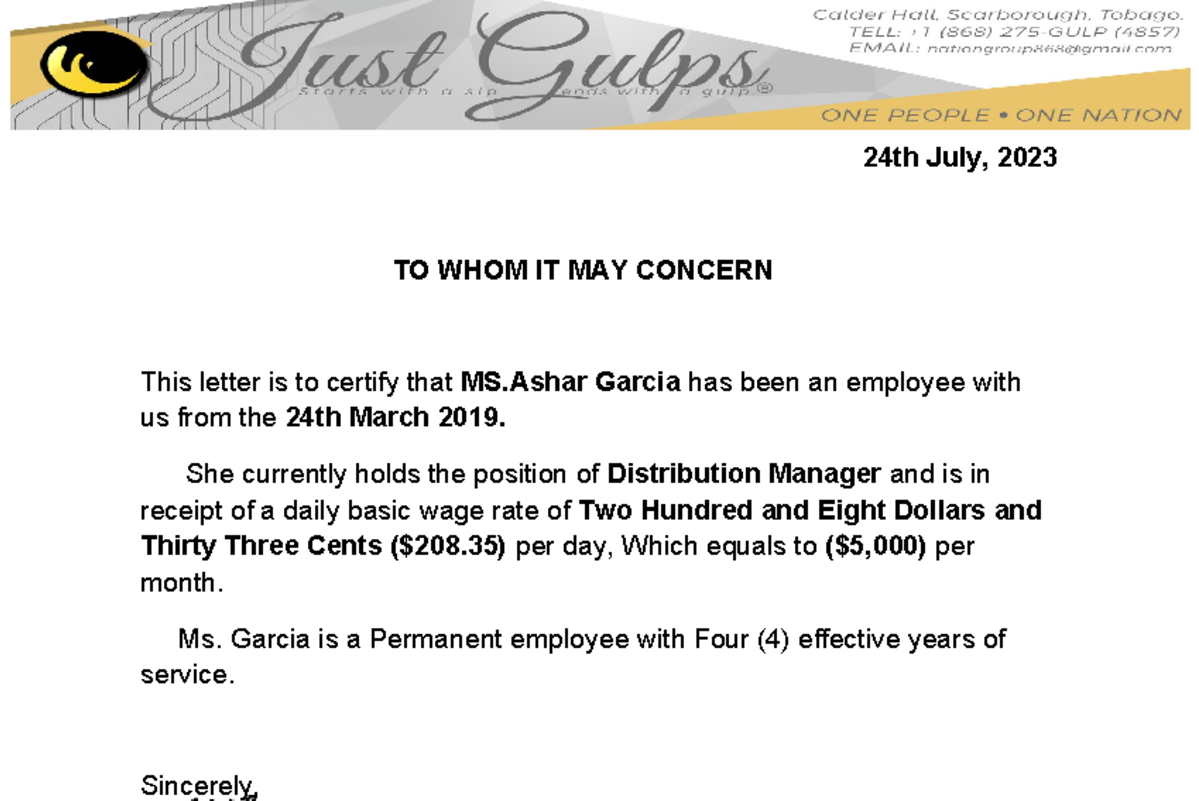

An Updated Job Letter

An updated job letter outlines the applicant’s current job title, current salary and compensation details, which are crucial for assessing the applicant’s ability to repay a loan.

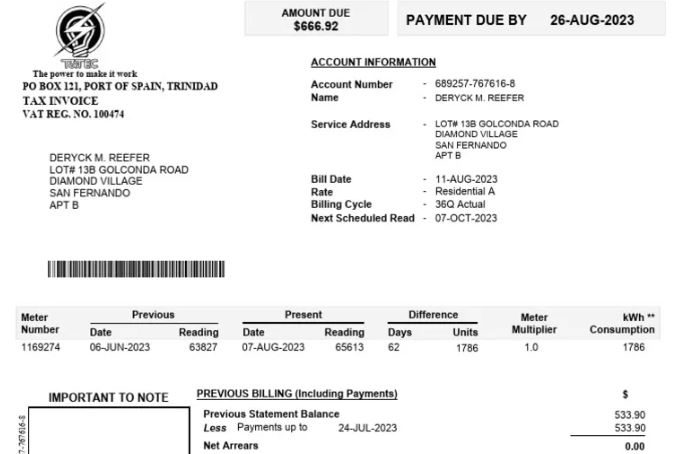

A Recent Utility Bill

If the utility bill is not registered on the member’s name, a letter of authorization from the bill owner and a copy of the bill owner’s identification is required along with the bill.

Shares Savings

Your Shares Account is the main account held at the Credit Union and represents part ownership of the Credit Union.

As a Shareholder you are entitled receive Dividends annually which is declared at the Credit Union’s Annual General Meeting. In 2018 Apex Credit Union declared a Dividend of 3.75%.

In order to become a member of Apex Credit Union you must purchase at least five (5) Shares valued at $5.00 each.

Consumer Loans

Our Consumer Loans are Short Term Regular Loans offered to Credit Union members to cover annual expenses such as Insurance, Medical Expenses, Vehicle Repairs, Family Vacations and other Household Expenses.

The loan value is based on your Shares Savings. Share requirement is based on your membership as well as Credit Rating. Consumer Loans attract low interest rates.

All Loans are subject to Credit Committee approval.

Vehicle Mortgages

Our Vehicle Mortgages are for the financing of Motor Vehicle Purchases only.

The vehicle is to be held by Apex Credit Union as collateral until the loan has been repaid in full.

We offer the most competitive interest rates on Vehicle Loans ranging from 0.458% per month for the purchase of New Vehicles to 0.625% per month for the purchase of Roll On/Roll Off or Used vehicles < 5 years old.

Repayment Term varies from 5 years (used) – 8 years (new).

Insurance Coverage must be fully comprehensive and assigned to the Credit Union for the term of the loan.

Family Indemnity Plan

Our family indemnity plan offers you financial relief during your bereavement time when your loved ones pass away.

Covers you and 5 other eligible family members including:

Your spouse, two parents can be selected from your parents and your parents in laws (parents must be enrolled before age 76 and get lifetime coverage) and your children (ages 1-25 and not yet married). Permanently disabled children are covered for the duration of their lives once enrolled before age 26.

No medical examinations are required.

There are six (6) plan options to choose from which is very reasonable to suit your budget.

Check us today for more details.

Additional Services

Loan Protection Insurance

Loan Protection Insurance covers all Credit Union Loans up to $100,000.00.

Your Credit Union Loans will be paid off in the event of death or permanent disability.

The borrowing member bears the cost of this insurance and no medical is required.

Family Critical Illness Plan

Provides critical illness coverage for you and up to FIVE eligible family members.

You can access up to $300,000 worth of coverage should you or any of your family members become diagnosed with one of the six covered critical illnesses: cancer, heart attack, stroke, paralysis, major burns and coma.

No medical is required.

Check us today for more information.

What are you waiting for?

Explore our services and get in touch today for a consultation. Together, we’ll make it happen.

Meet Our Team

Total Assets Over The Years

Testimonials

“Professional and friendly staff, I felt well taken care of.“

Elisha Holder

“This service was fantastic. I couldn’t be happier!”

Christina Jaikaran

“Quick and easy approval with all my documents.”

S. Richardson

Contact us

Send us an email